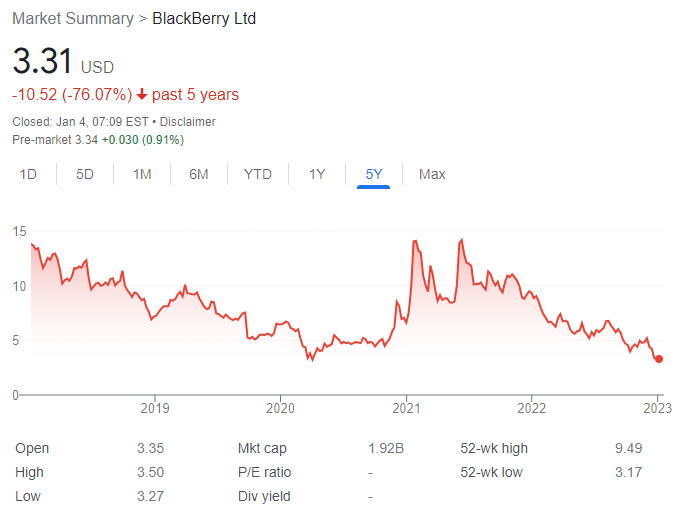

As one of the leading technology companies located in Ontario, Canada, Blackberry’s ticker symbol on the New York Stock Exchange is BB. The Blackberry stock closed at $3.31 – a 1.53% increase from last day’s closing price but still 64.67% lower than it was 12 months ago. When compared to Software – Infrastructure industry stocks, Blackberry stock has underperformed by 0.27 percentage points. Currently, the price of BB is trading at $3.31 per share- a +4.42% increase from its 52-week low and a 64.6% decrease from its 52-week high of $9.35 per share; there are 580M shares outstanding with a market value totaling 1B2 USD in the last 24 hours alone traded 937M BB shares!

How to Buy Blackberry Stock

Investing in Blackberry stock has never been easier! You can open an account with any of the major brokers – TD Ameritrade, Charles Schwab, or E-Trade – and deposit funds to start investing. And if you’re looking for a more streamlined experience, try out Robinhood or Fidelity’s online trading platforms! All it takes is a quick search for “BB” and you’ll be able to purchase the stock swiftly and securely. Get ready to reap some rewards from your investments today! The process for opening an account is like setting up a brokerage but with more accessible technology and reduced fees. After your account has been set up, you’ll be able to easily search for the BB stock that you wish to purchase.

Investing in stocks comes with inherent risk, so you should only allocate funds that you are comfortable potentially losing. To maximize your chances of success and yield the greatest returns over time, we strongly suggest researching each stock thoroughly prior to committing capital and obtaining professional financial advice.

Blackberry Fundamentals

Before you invest in Blackberry stock, it is important to understand the key fundamentals of the company. This includes how they generate revenue and what areas they operate in. Blackberry primarily operates in the software and services market, providing mobile phone technology and other related products such as cybersecurity solutions. The company also has partnerships with other technology companies such as Microsoft and Google. Additionally, Blackberry has recently ventured into the healthcare sector with its new product, BlackBerry Health Platform. It is important to understand how these factors could play a role in the company’s stock performance before you start investing. Understanding how stocks work can help you better make decisions when investing your money and maximize your chances of success.

BlackBerry Ltd

Most Recent BB Analyst Ratings

Analysts can provide valuable insight into how they believe a company is performing and how its stock may perform in the future. Currently, analyst consensus has Blackberry rated as a “Buy”. Analysts believe that BB will outperform the market and continue to increase in price over the next 12 months. Given this information, it’s wise to consider how Blackberry is positioned and how it could affect your decision to invest in its stock.

On August 12th, 2022, Luke Junk of Baird announced his initiation of coverage on BB with a hold rating and price target set at $7.00. Then subsequently, Michael Walkley from Canaccord Genuity declared their decision to maintain the same rating but lower the price target from $6.00 to $5.50 on September 28th,2022 followed by Paul Treiber’s similar decision slightly later on December 21st that year as the analyst for RBC Capital settled for a more conservative price tag of only $5.50.

Heather Hachigian works as a research associate at the Carleton Centre for Community Innovation and as a consultant with Purpose Capital, where she helps investors identify opportunities and strategies for implementing their responsible investment programs.