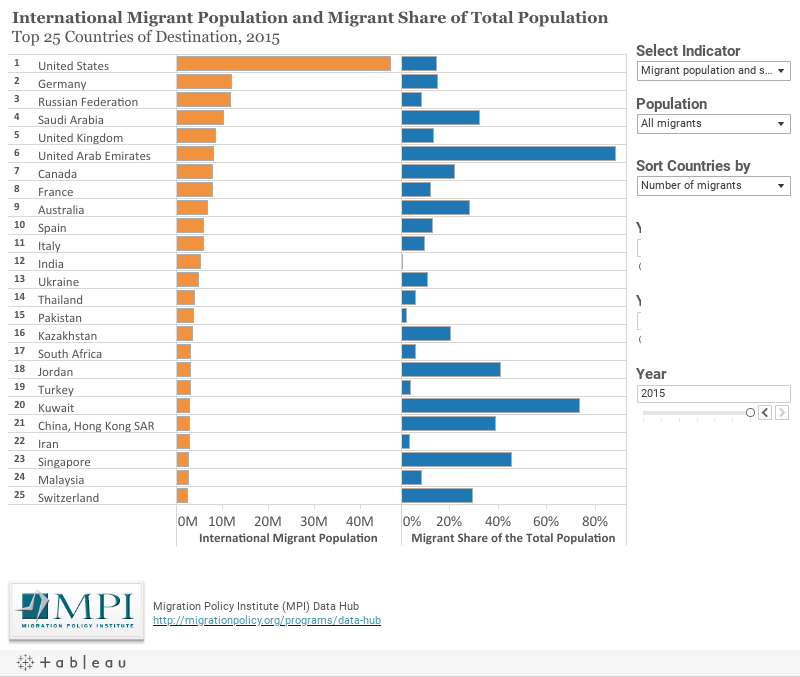

THE MIGRANT SHARE OF TOTAL POPULATIONS IS INCREASING

In 2015, 3.3% of world’s population – 244 million people – were living in a country that is different than the country where they were born

THE MAJORITY OF GLOBAL MIGRANTS ARE OF WORKING AGE

In 2015, 72 % of all international migrants were between the ages of 20 to 64 years, compared to 58 % of the total world’s population.

THE ECONOMIC IMPACTS OF MIGRANTS ON THEIR HOST COMMUNITIES DEPENDS

– not only on the socio-demographic characteristics of migrants but also – on the host country’s integration policies and the presence of an inclusive business culture.