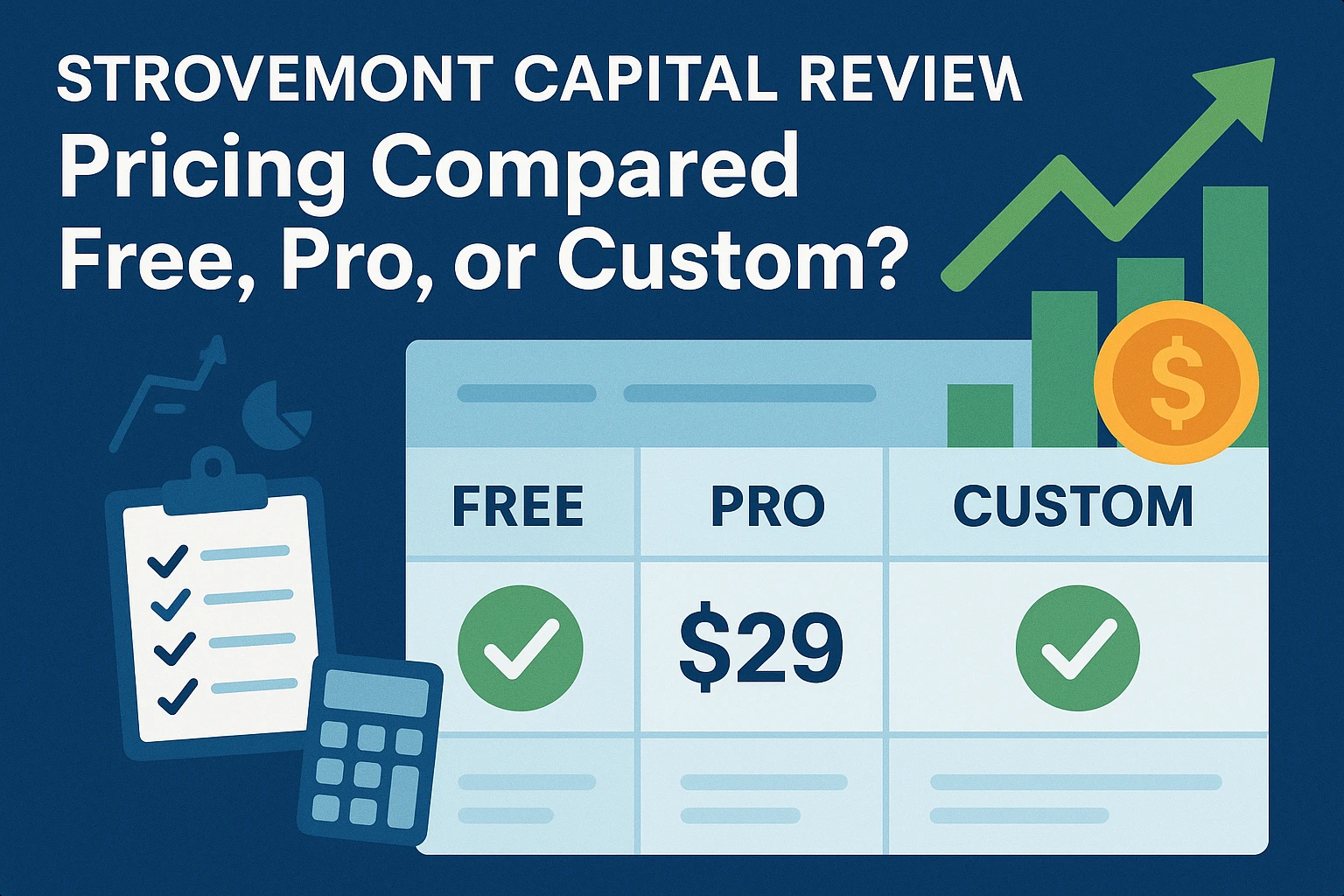

Choosing an investment platform is never just about features — it is also about cost. Every investor wants to know whether the price they pay reflects the value they receive. Strovemont Capital has built its pricing model to cater to different types of clients, from cautious beginners to experienced wealth-builders. In this review, we explore the three available plans — Free, Pro, and Custom — and explain how each can fit specific investor needs.

Why Pricing Matters in Wealth Management

In wealth management, transparency is everything. A platform that hides fees or adds surprise charges creates mistrust. Strovemont Capital takes the opposite approach: its pricing is simple, clearly presented, and aligned with the philosophy of fairness. Instead of confusing tiers or hidden commissions, clients are offered three straightforward plans that cover a broad range of financial goals.

This approach means that investors always know what they are paying for — and why.

The Free Plan: A Safe Entry Point

For many beginners, the first step into wealth management can feel intimidating. The Free plan is designed to remove that fear. It allows users to explore the platform, test basic tools, and start building confidence without making an immediate financial commitment.

Although limited compared to higher tiers, the Free plan covers essential features such as account setup, standard support, and access to general strategies. It’s ideal for those who are still learning about investment or simply want to see if Strovemont Capital matches their style.

The Pro Plan: For Ambitious Investors

The Pro plan, priced at $249, is the heart of Strovemont Capital’s offering. It is designed for investors who want more control, more flexibility, and more growth opportunities. While the Free plan opens the door, the Pro plan takes you inside and gives you the keys to a wide range of advanced features.

Subscribers to this plan receive priority support, customizable strategies, and automated portfolio execution. This means that while the platform’s systems do the heavy lifting, the investor retains the ability to shape how their capital is allocated. For those serious about balancing stability with growth, the Pro plan is the clear choice.

The Custom Plan: Tailored to Individuals

Some investors do not fit into categories. They require something unique: personal guidance, bespoke strategies, and high-level support. The Custom plan is Strovemont Capital’s premium tier, offering exactly that.

Here, clients are assigned a dedicated wealth manager who helps design strategies around personal goals. Whether the focus is legacy planning, multi-generational asset transfer, or specific growth targets, the Custom plan ensures that every detail is considered. Pricing is flexible and discussed individually, reflecting the personalized nature of the service.

Comparing the Three Plans

To truly understand the differences, it helps to see how each plan serves different investor profiles:

- Free Plan – best for newcomers who want to explore without financial risk.

- Pro Plan – suited to active investors ready to grow wealth with professional tools.

- Custom Plan – ideal for high-net-worth individuals seeking tailored solutions.

Each plan carries its own strengths, and together they cover the full spectrum of wealth management needs.

Value Beyond the Price Tag

Price alone doesn’t tell the full story. What sets Strovemont Capital apart is the value attached to each plan. Investors aren’t paying for access to generic tools; they are investing in security, expertise, and a philosophy that puts trust first. The Pro plan, for example, might seem like a significant commitment, but for many clients it pays for itself by providing clarity, automation, and professional oversight that would be hard to replicate independently.

Benefits That Apply to All Plans

While the features of each plan differ, there are advantages that every client enjoys regardless of tier. These include:

- Access to a platform built on 25+ years of expertise.

- Strong security protocols protecting both funds and data.

- Transparent communication about risks and opportunities.

- A client-first philosophy with high retention rates.

This means even Free users benefit from the reputation and trust that Strovemont Capital has built over decades.

What Clients Say About the Plans

Testimonials provide an honest picture of how the pricing model works in practice. One Free plan user explained: “I started at no cost, and within weeks I felt confident enough to upgrade.” A Pro subscriber wrote: “The $249 plan seemed expensive at first, but the tools and support are worth far more than the price tag.” And Custom clients often emphasize the personalized service, describing it as “a partnership rather than a transaction.”

These real experiences highlight that the cost is justified by the results and reassurance clients receive.

Conclusion

Strovemont Capital’s pricing structure is simple, fair, and adaptable. The Free plan lowers the barrier for beginners, the Pro plan offers powerful tools for ambitious investors, and the Custom plan delivers tailored strategies for those who demand the highest level of service.

By making its pricing transparent and tying each tier to clear value, Strovemont Capital proves that wealth management doesn’t have to be complicated. Instead, it can be accessible, flexible, and trustworthy — whether you are just beginning or already planning a financial legacy.