The world of cryptocurrency trading is rapidly evolving, and the popularity of both centralized and decentralized exchanges (CEX and DEX, respectively) is growing. With the rise of digital currencies, the number of platforms where users can buy, sell, and trade cryptocurrencies has also increased. In this article, we aim to provide a comprehensive explanation of the differences between CEX and DEX, and to explain why many users prefer using centralized exchanges.

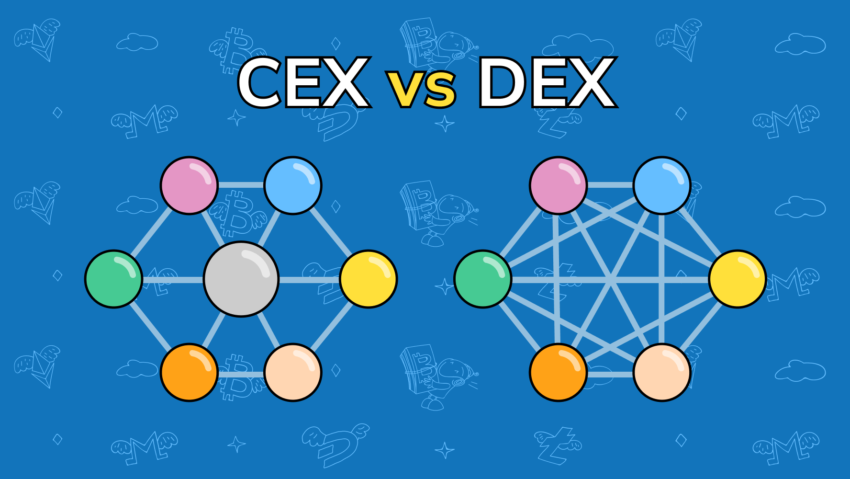

A centralized exchange, or CEX, is a platform that acts as a middleman between buyers and sellers of cryptocurrencies. The exchange holds the users’ funds and is responsible for executing trades, making it the central point of control. In contrast, a decentralized exchange (DEX) operates on a peer-to-peer network and allows users to trade cryptocurrencies directly with each other, without the need for intermediaries.

Let’s compare and contrast CEX and DEX, highlighting their key differences and similarities. The article will examine the pros and cons of each type of exchange, and explore the reasons why many users prefer centralized exchanges over decentralized ones. By the end of this article, readers will have a better understanding of the trade-offs between CEX and DEX, and be able to make informed decisions about which type of exchange is best suited to their needs.

Centralized Exchanges (CEX)

Centralized exchanges, or CEXs, are a type of cryptocurrency trading platform that operates as a centralized authority, serving as the intermediary between buyers and sellers. CEXs are responsible for executing trades and holding the users’ funds. In other words, they are the central point of control in the trading process.

CEXs are defined by their centralized nature, where a single entity has control over the platform’s operations. This includes managing the order book, executing trades, and holding the users’ funds. As a result, CEXs have a higher level of control over the trading process, which can make them more appealing to users who prioritize security and regulation.

Advantages of using CEX

According to tradecrypto.com academy, CEXs offer a number of advantages for users, including a user-friendly interface, high liquidity and trading volume, fast transaction speeds, customer support, regulation, and security measures.

User-Friendly Interface

One of the biggest advantages of using a centralized exchange is its user-friendly interface. CEXs are designed to be simple and easy to use, even for those who are new to cryptocurrency trading. They often have a straightforward process for buying, selling, and trading cryptocurrencies, making it easy for users to get started and execute trades quickly.

Liquidity and Trading Volume

Centralized exchanges typically have high liquidity and trading volume, which means that users can buy and sell cryptocurrencies quickly and easily. This is especially important for traders who are looking to make large trades, as high liquidity can prevent significant price fluctuations that can occur in low-liquidity markets.

Fast Transaction Speeds

Another advantage of using a centralized exchange is fast transaction speeds. CEXs typically use advanced technology to process trades quickly, which means that users can execute trades and receive their funds more quickly than they would on a decentralized exchange.

Customer Support

Centralized exchanges often provide customer support, which can be particularly beneficial for users who need assistance with issues such as account setup, security, or technical problems. Having access to customer support can give users peace of mind, knowing that there is someone available to help them resolve any issues they may encounter.

Regulation

Many centralized exchanges are subject to regulation, which can provide users with additional security and peace of mind. Regulated exchanges are required to comply with various regulations and security measures, which can reduce the risk of fraud or hacking.

Security Measures

Security is a top priority for centralized exchanges, as they hold a large amount of users’ funds. As a result, CEXs typically employ advanced security measures, such as two-factor authentication and cold storage, to protect users’ funds and ensure the safety of their assets. Additionally, many CEXs are insured, which can provide users with additional protection in the event of a hack or loss of funds.

Decentralized Exchanges (DEX)

Many people don’t even know that DEX exchanges exist, so what is DEX?

Decentralized exchanges (DEXs) are a type of cryptocurrency exchange that operates on a decentralized platform. Unlike centralized exchanges, DEXs do not hold users’ funds, instead, they allow users to trade directly with one another using smart contracts. The trades are executed automatically, without the need for a middleman or central authority.

Advantages of using DEX

Decentralized exchanges (DEXs) are a type of cryptocurrency exchange that operates on a decentralized platform, allowing users to trade directly with one another using smart contracts. The trades are executed automatically, without the need for a middleman or central authority.

Decentralization and Security

One of the key advantages of using a DEX is that it is decentralized, meaning that there is no central authority holding users’ funds. This makes DEXs less vulnerable to hacks or security breaches compared to centralized exchanges.

Privacy and Anonymity

DEXs also offer greater privacy and anonymity compared to centralized exchanges. Users do not need to provide personal information to trade on a DEX, and their transactions are not recorded on a central server, providing greater privacy.

Lower Fees

DEXs typically charge lower fees compared to centralized exchanges, as there is no middleman or central authority to take a cut of the profits.

No Restrictions or Regulations

DEXs are not subject to the same restrictions and regulations as centralized exchanges, which means that users have more freedom to trade as they please.

Control Over Funds

With a DEX, users have full control over their funds, as they are stored in a personal wallet rather than being held by a central authority. This gives users greater control over their assets and reduces the risk of theft or loss.

Comparison of CEX and DEX

Centralized Exchanges (CEX) Pros:

- User-friendly interface

- High liquidity and trading volume

- Fast transaction speeds

- Customer support

- Regulation

- Advanced security measures

Centralized Exchanges (CEX) Cons:

- Centralized nature makes them vulnerable to hacks

- Regulation can lead to restrictions and limitations on trading

- User data is at risk of being compromised

- Centralized exchanges hold users’ funds, which can be at risk of theft or loss

Decentralized Exchanges (DEX) Pros:

- Decentralized nature makes them more secure

- Greater privacy and anonymity

- Lower fees

- No restrictions or regulations

- Users have full control over their funds

Decentralized Exchanges (DEX) Cons:

- User-unfriendly interface

- Low liquidity and trading volume

- Slow transaction speeds

- Lack of customer support

- No regulation or security measures in place

Conclusion

This article has provided a comprehensive overview of both centralized exchanges (CEX) and decentralized exchanges (DEX), including their definition and characteristics, as well as their advantages and disadvantages. CEXs are characterized by their user-friendly interface, high liquidity and trading volume, fast transaction speeds, customer support, regulation, and advanced security measures. On the other hand, DEXs are decentralized, offering users greater security, privacy, and anonymity, lower fees, and control over their funds.

The choice between a CEX and a DEX ultimately comes down to the individual user’s needs and preferences. For those who value ease of use and customer support, CEXs may be the preferred choice, while those who prioritize privacy, control over their funds, and low fees may prefer DEXs.

As the cryptocurrency industry continues to evolve, it is likely that both CEXs and DEXs will continue to play a significant role in the space. However, the growing demand for greater privacy, security, and control over funds may lead to an increase in the popularity of DEXs.

Ultimately, whether a user chooses a CEX or a DEX, it is important to do thorough research and carefully consider their individual needs and preferences before making a decision. Both types of exchanges have their own unique advantages and disadvantages, and users should be aware of these when making a choice. Additionally, users should always ensure that they are using a reputable exchange and take appropriate measures to secure their funds, regardless of whether they choose a CEX or a DEX.